Every year, U.S. businesses and developers leave tens of billions of dollars in tax incentives, credits, and abatements unclaimed. These missed opportunities represent more than lost dollars — they mean delayed projects, underutilized land, and communities left waiting for revitalization.

Nowhere is this clearer than in brownfields redevelopment — one of the most incentive-rich yet underleveraged areas of real estate and infrastructure development.

Brownfields: A $33 Billion Case Study

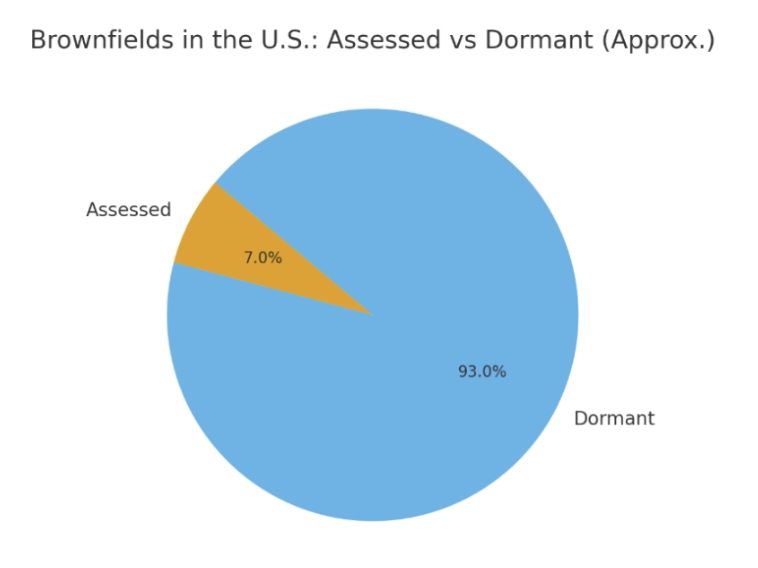

The U.S. has an estimated 450,000 brownfield sites — properties where real or perceived contamination complicates redevelopment. According to a recent study (PMC, 2023):

- < 7% of brownfields have even undergone assessment.

- Only ~2,000 sites have been fully cleaned up.

- The EPA's Brownfields Program has still managed to leverage $33+ billion in private investment and prepare 130,000 acres for reuse.

The potential is staggering. Yet most sites remain idle, in part because developers undervalue or overlook the incentive landscape that can tip projects into viability.

The Scale of Missed Incentives

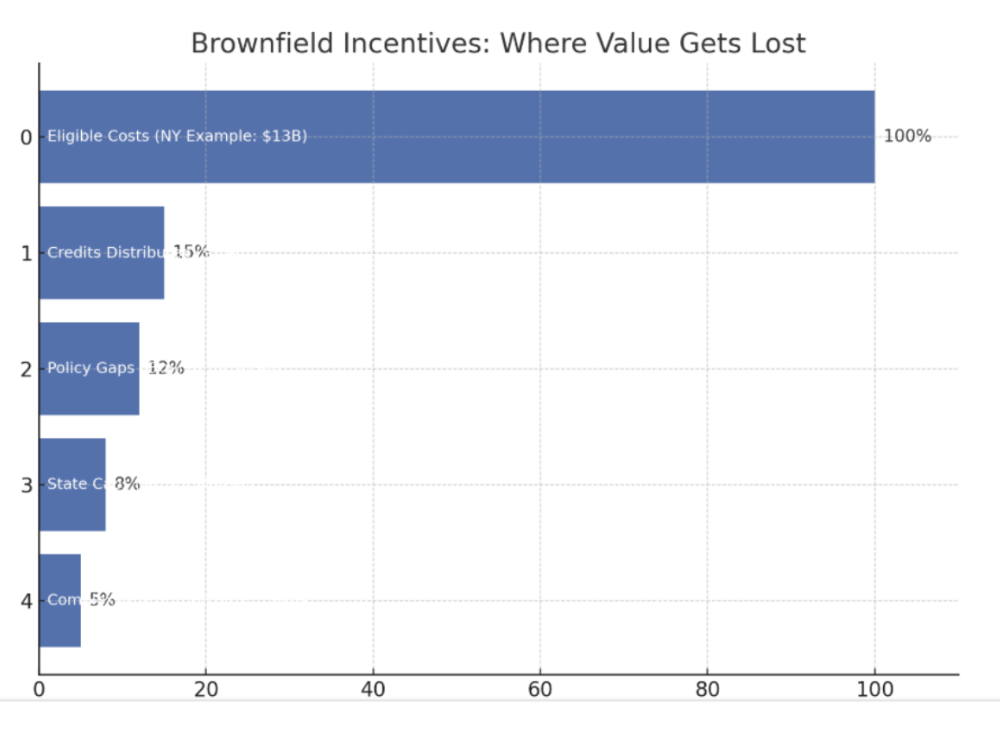

Even in programs designed to encourage brownfield redevelopment, large amounts of incentive value are left on the table.

For example, New York's Brownfield Cleanup Program reports nearly $13 billion in eligible costs, but only $1.98 billion in credits distributed from 2005–2018 — a realization rate of just ~15% (NYCBP).

At the federal level, the Brownfields Tax Incentive (IRC §198), which allowed immediate deduction of remediation expenses, expired in 2011 and has yet to be reauthorized, cutting off a key incentive tool (EPA archive).

State programs also impose ceilings, such as New Jersey's $50M/year cap, which restricts how much remediation support can flow to projects (NJEDA). Finally, complex eligibility rules, liability hurdles, and heavy documentation requirements further discourage full utilization, reinforcing the reality that billions in brownfield and Superfund-related tax incentives remain unclaimed.

Why Incentives Go Unused in Brownfields

We see why some of these incentives are underutilized:

- Data Fragmentation: Incentives vary by federal, state, and local jurisdictions, while contamination and remediation data live in separate silos. Understanding eligibility is complex too.

- Timing & Compliance: There is a time pressure. Incentives are tied to strict project timelines, cleanup milestones, and regulatory filings. And it is hard to keep up.

- Perceived Risk: Without transparent data on incentives and compliance, developers assume brownfield projects aren't worth it.

The Cost of Inaction

When brownfields sit idle, communities lose tax revenue and job growth. Developers miss out on layered incentives — from EPA grants to state cleanup credits to local abatements. And, Investors overlook viable projects that could be financially de-risked through incentive stacking.

The result: 450,000 dormant opportunities across the country.

The Bottom Line

Tax incentives are not "extra credit." They are a core part of the financial equation for infrastructure, clean energy, and real estate development. Brownfields show just how much potential is wasted when incentives go unused.

With the right tools, developers can transform underutilized land into thriving projects — and ensure every available dollar of incentive value is captured, not left behind.

Want to see how Dodda.ai can surface hidden incentive value across your pipeline? Get in touch for a tailored demo.